Earning more than 10 Lakhs a year? You have no idea how rare you are.

In this Memo, we delve into India's direct tax data to figure out just how many people earn over what amount. Dive in to see where you stand.

The Central Board of Direct Taxes (CBDT) has released aggregated data for the Direct Tax collections in India for the Assessment Year 2018-19. Here’s what our analysis has reveals about the Indian taxpayer:

But first,

What are Direct Taxes?

Direct Taxes are taxes that are paid directly to the government. It includes Income Tax on incomes of all forms like salaries, rental income, capital gains and professional or business income.

How Many Taxpayers?

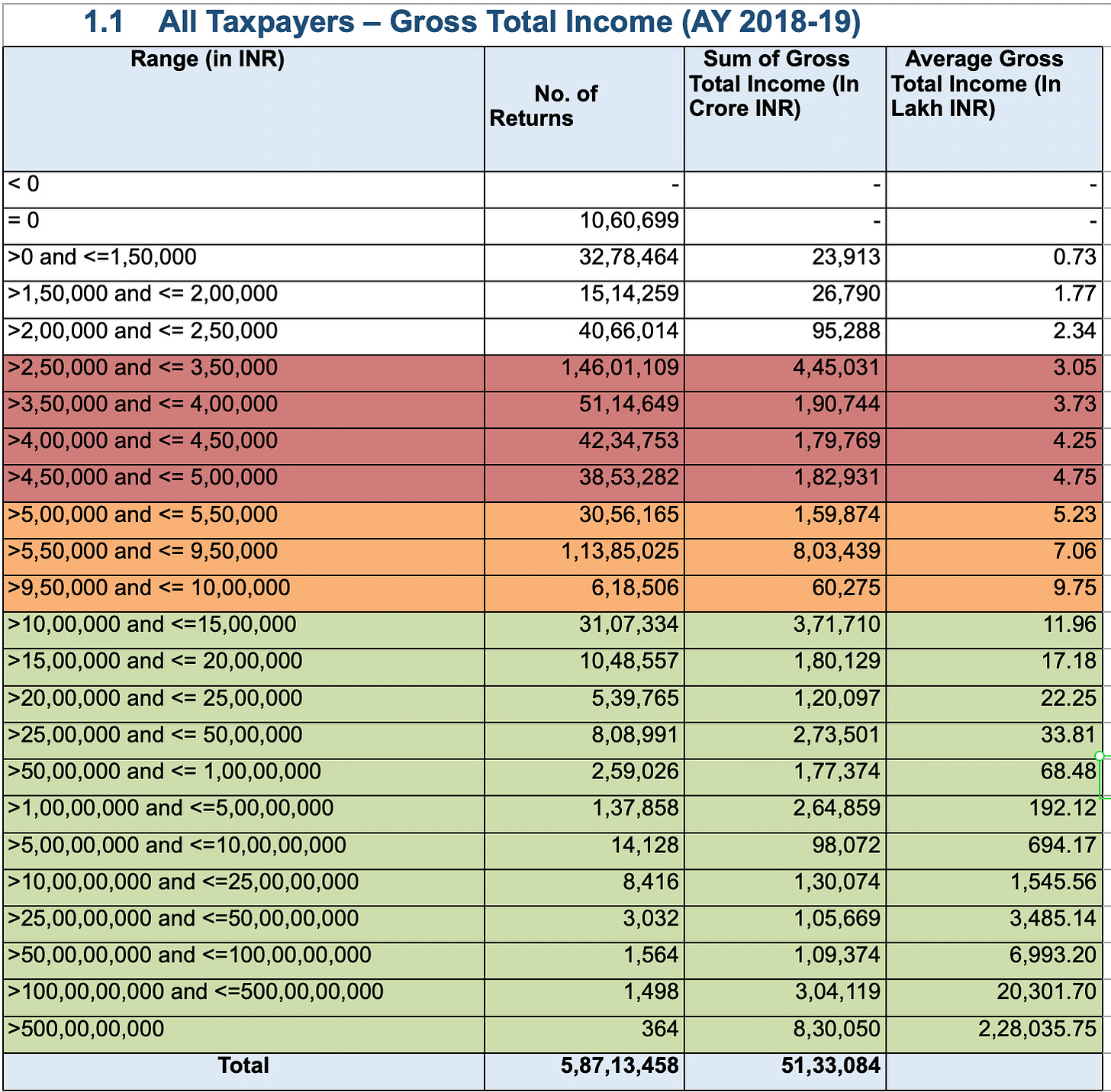

There were 5,87,13,458 (5 Crore 87 Lakhs) returns filed in AY 2018-19, the latest year for which the full statistical report is available. In AY 2021-22, which ended on March 31, 2022, 7 Crore 14 Lakh tax returns were filed. This means that in 3 years, this number grew by 1 Crore 27 Lakhs, a compounded annual growth rate of 6.75%. This is very respectable growth.

For the record, there are 43 Crore 34 Lakh pan cards linked to Aadhaar as per the government. India’s working age population (those in the 15-64 years bracket) is 67.51% of its total population of approximately 140 Crore people. That comes to 94 Crore people. Considering close to half are female, and India’s female workforce participation rate is an abysmal 29.4% as per the Periodic Labour Force Survey, even ignoring those below the poverty line and those engaged solely in agriculture, there doesn’t seem to be a significant chunk of the population outside the tax net. People might be underreporting, but they’re still in the tax system.

Now to the numbers! Who makes how much?

Out of the 5.87 Crore returns filed, 5.52 Crore were Individuals. 11.3 Lakh Hindu Undivided Family (HUF), 12.69 Lakh firms (businesses that aren’t companies), 2.04 Lakh Association of Persons (AOP) or a Body of Individuals (BOI) (people coming together to launch a venture, like self help groups and farmer producer organizations), and 8.41 Lakh companies.

Though data breakdown for all these categories is available, let’s take all taxpayers collectively. If you want the split for just individuals or companies, let me know in the comments or email me, and I can do that breakdown in the next email.

For now, the money:

Out of the 5.87 Crore tax returns, there were 364 entities earning over INR 500 Crore (~USD 61 Million). For those curious, only 3 of these were Individuals!

59.3 Lakh entities made over 10 Lakh rupees a year (~USD 12,200). That’s 10.1% of the tax filers, and a mere 0.6% of the country’s 94 Crore working age population.

1.5 Crore entities were in the 5 Lakh to 10 Lakh bracket (USD 6,100 to 12,200). That’s 25.5% of the tax filers, and 1.6% of the working age population.

2.78 Crore entities were between 2.5 Lakh and 5 Lakh (USD 3,050 to 6,100). That’s 47.3% of the tax filers.

The remaining 99.1 Lakh filers were below 2.5 Lakh in annual total income. That’s 16.8% of the tax filers.

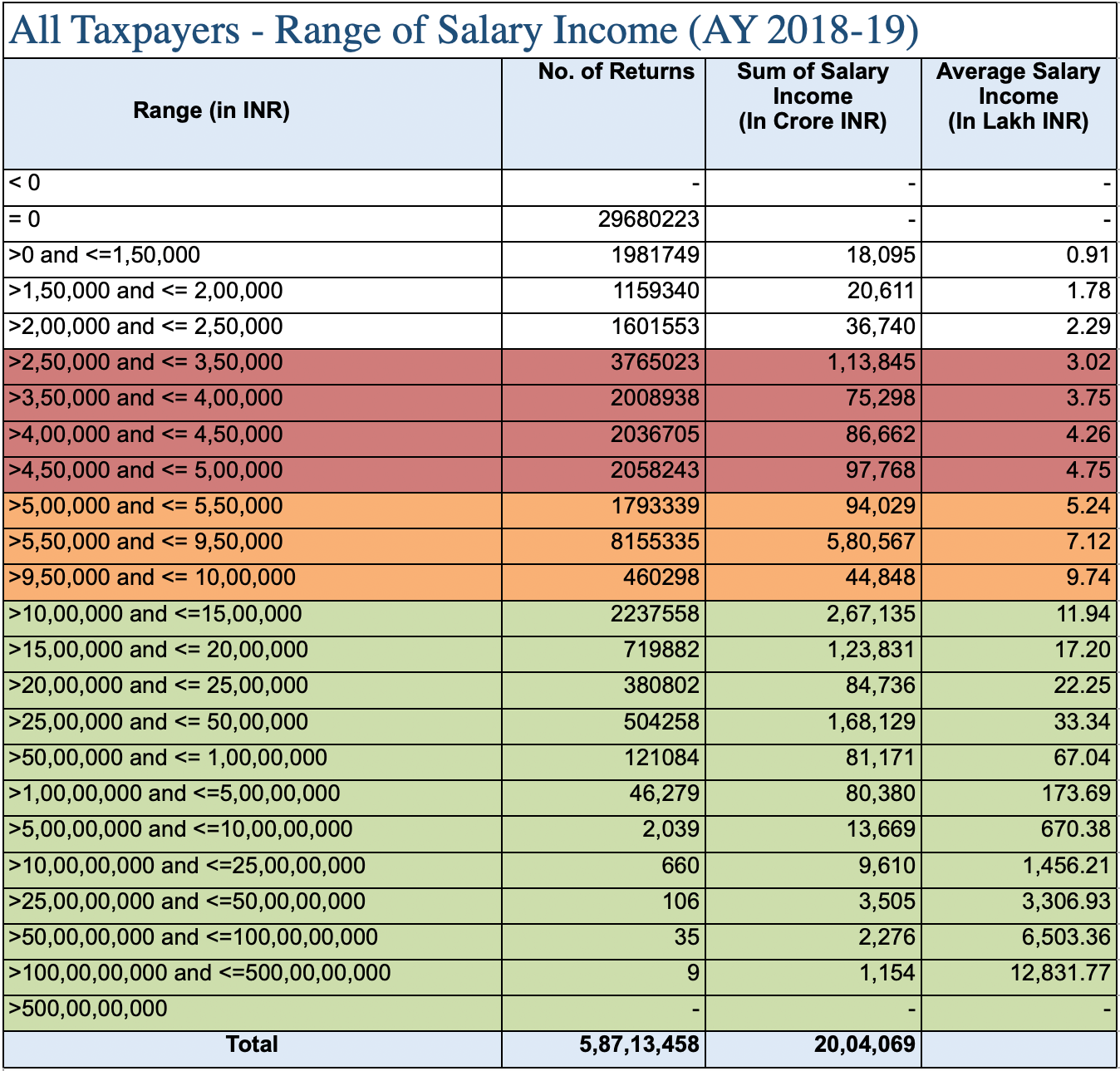

In the over 10 Lakh earning category, there were 59.3 Lakh entities as we covered earlier. If we look at who achieved this solely through a salary (taking out business income, rents, capital gains and other sources of income), then 40.12 Lakh people in all of India had a salary of over INR 10 Lakh! That’s a VERY low number for a country the size of India.

2.02 Crore had salaries between INR 2.5 Lakh and INR 10 Lakh, and the rest were below that.

So basically if you earn over 10 Lakh in salary every year, you’re already in the top 0.29% of India’s population! And if you earn over 2.5 Lakhs a year, you’re in the top 1.73% of the country’s population.

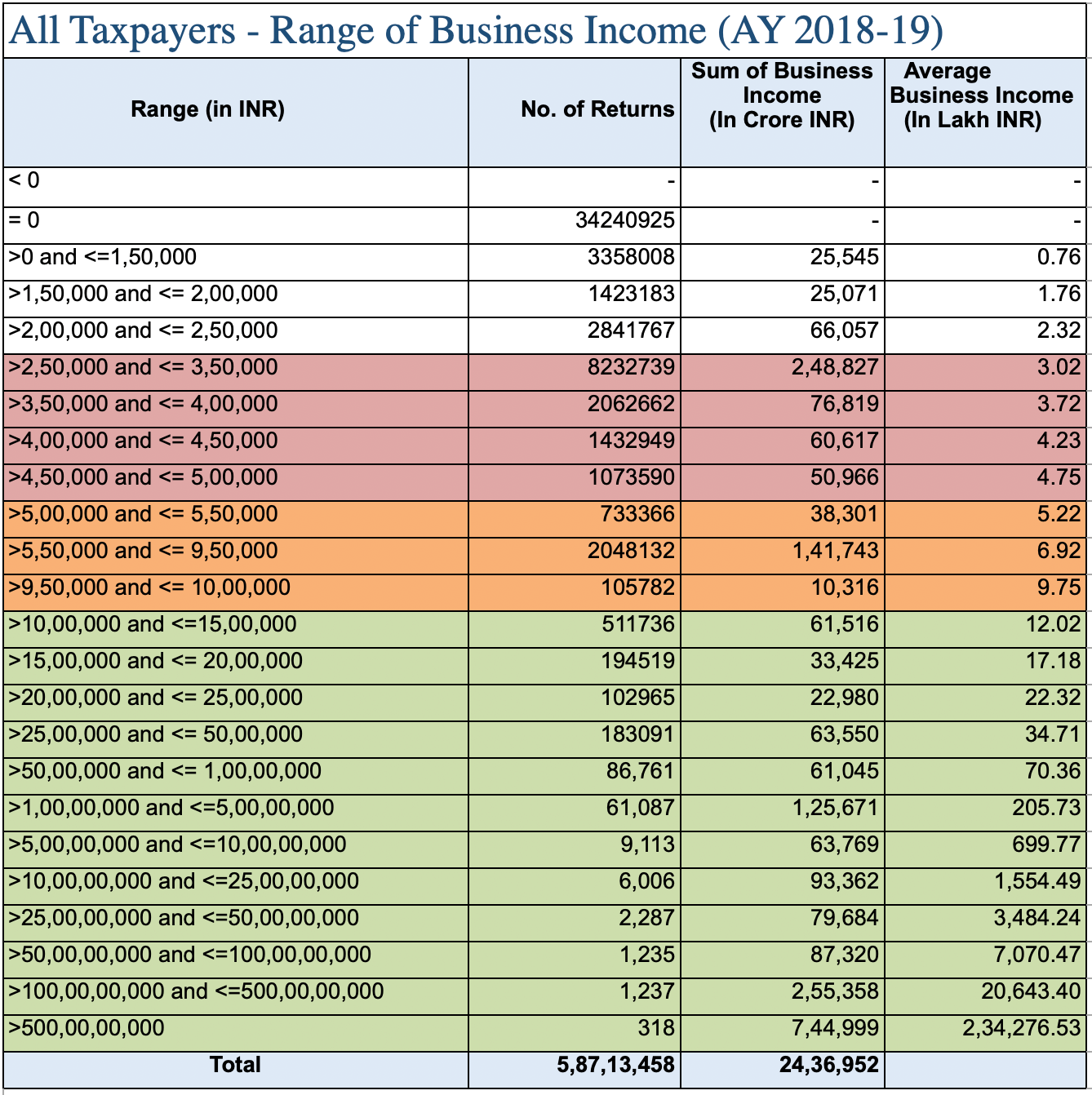

If you earn a business income of over INR 10 Lakhs a year, then you’re in an even rare group of just 11.6 Lakh entities!

Between 5 Lakhs and 10 Lakhs a year of business income? Still extremely rare. Just 28.87 Lakh entities.

There were 1.28 Crore entities with a business income between 2.5 Lakh and 5 Lakh.

That’s it for this Memo. But please do share our work, and don’t forget to subscribe for future data based insights. We’ll be doing more in depth analysis of India’s tax data and other data sources to see just how big India’s middle class really is!